Whether you’re in the market to buy your first home or you’ve been around the block once or twice, chances are you’ve probably heard some of these homebuying myths before! Some may even have you worried that buying a home is impossible. Well, you’re in luck! Here are some common misconceptions surrounding the homebuying process that we will be happy to bust!

You need 20% down-payment.

It’s true that paying 20% down or more means you won’t need to pay for private mortgage insurance, but if you have good credit and a steady income, putting less down can allow you to start building equity sooner rather than later. In 2019, the National Association of Realtors found that the average down payment on a house or condo was 12% and just 6% for first–time homebuyers!

You need a perfect credit score.

A higher credit score may get you a better interest rate, but you can still purchase a home with less-than-perfect credit! Lenders are looking at your overall financial picture, including your income, debts, assets and down-payment – not just your credit score. The minimum score for a conventional mortgage is generally around 620; however, some government-backed loans have even lower credit score requirements. That being said, it is always best to improve your credit as much as possible before applying for a mortgage!

You must pay off your student loans first.

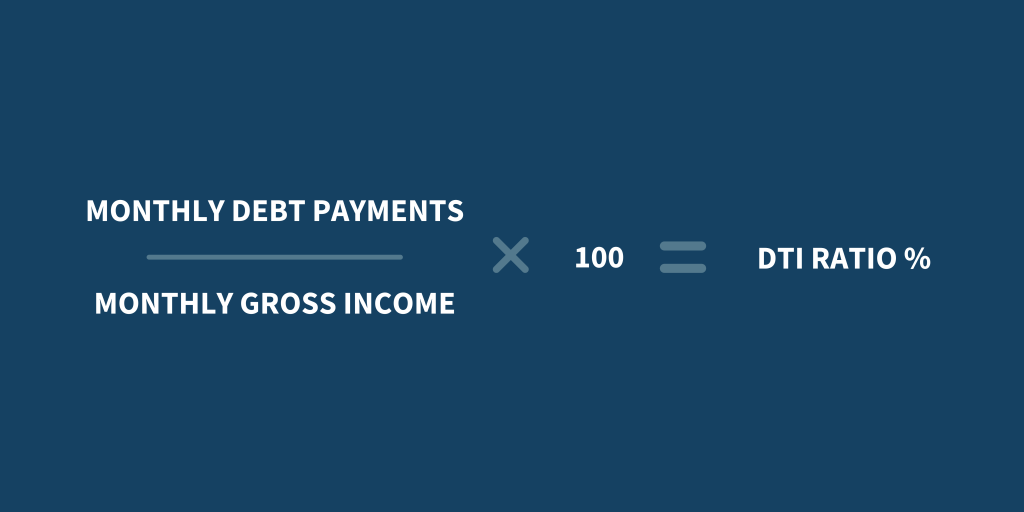

Don’t write off buying a home just because you have student loans! Keep in mind that lenders don’t usually look at your total student debt, but rather how much you pay each month. For most lenders, it’s not about the type of debt you have but rather how well you can manage it. They are more interested in your monthly debt-to-income ratio, which you can calculate using the equation below. (The lower, the better!)

It is cheaper to rent.

Buying may cost you more upfront – with a down-payment, closing costs, moving fees and more – but long-term, owning a home is a better investment for your future. A mortgage payment may cost you the same as your rent each month, but the difference is what that money is going towards. When you own a home, your monthly mortgage payments get you one step closer to owning your home, leaving you with equity that you can use in the future – whereas your rent is going right into your landlord’s pocket.

Learn more about our home financing process by visiting our website!