When it comes to borrowing money, your creditworthiness is a key factor lenders consider when determining how likely you are to repay your loans. The higher your credit score, the more you are proving to lenders that you know how to manage your money wisely and that they can count on you to pay your dues. If you’re struggling with less-than-perfect credit, here are a few healthy financial habits that can help you improve your credit score over time!

Avoid late payments at all costs.

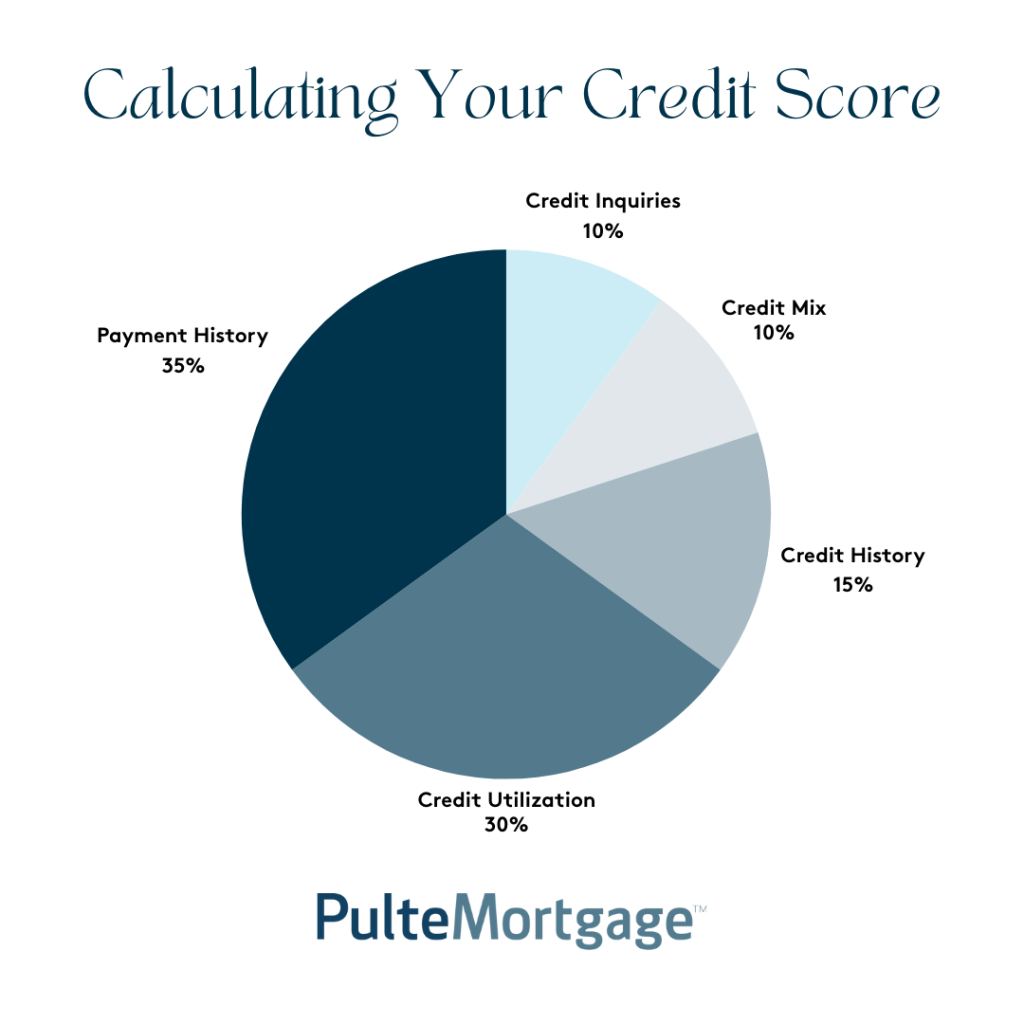

As you can see on the graph below, your payment history is the largest factor when it comes to your credit score. Late payments can stay on your credit report for 7+ years! We recommend setting up account reminders or automatic payments to cover at least the minimum payment each month to avoid negative dings on your credit report.

Pay down your balances as much as possible.

This one may seem obvious, but one of the most efficient ways to boost your credit score is to pay down the balances on your revolving debt as much as possible. Having too much revolving debt, such as high credit card balances, can appear risky to lenders.

Request a higher credit limit.

After payment history, your credit utilization is the second most important factor when calculating your credit score. Credit utilization is the percentage of your credit limit that you are using at any given time. For example, if you have a credit limit of $10,000 and you currently owe $2,500, your credit utilization is 25%. A good rule of thumb is to keep your total outstanding balances as low as possible.

To help lower your credit utilization while continuing to pay down your balances, you may want to try requesting a credit limit increase from your credit card company. If your credit card company increased your credit limit to $15,000 and your balance remained at $2,500, your credit utilization would then drop to 16%.

Dispute any errors on your report.

Under federal law, you are entitled to a copy of your annual credit report from all three credit reporting agencies – Experian, Equifax and TransUnion – once every 12 months. We recommend reviewing these reports annually to ensure all your credit information is correct and to better understand what is affecting your score. You may find an error on your report as the culprit for holding your credit score back!

If you notice an error, such as accounts you’ve never opened or incorrect payment dates, contact the credit bureau and the business that reported the information to dispute it. Keep in mind, your credit report will still show these disputes unless you ask the credit bureau to remove it from your report completely.

For more information on how to dispute inaccurate information, click here.

Consider consolidating your debts.

If you have several outstanding debts, it could be to your advantage to take out a debt consolidation loan. Having one monthly payment could help with on-time payments each month, and depending on your interest rate and loan terms on the loan, you could pay down your debt faster. Paying your debt down can improve your credit utilization ratio and, in turn, your credit score!