Mortgage amortization is the process of making payments that gradually reduce the amount you owe on a loan. Each time you make a monthly payment on an amortizing loan, part of your payment is toward interest while the rest is put toward the principal balance.

The interest on your mortgage is calculated based on the most recent balance of your loan. When you first start making payments on your mortgage, a large part will be used to cover the interest, which means only a small amount will go to the principal. As payments are made each month, the interest amount will decrease, leaving more of your monthly payment toward the principal balance.

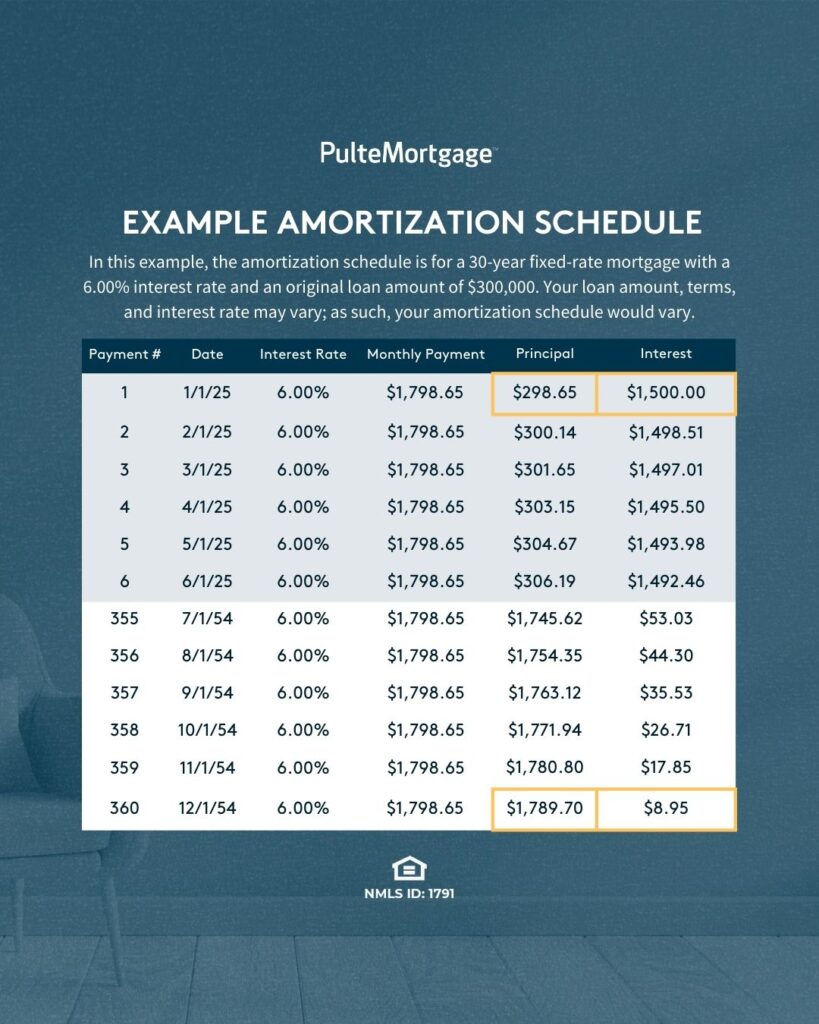

How to Read an Amortization Schedule

In the example below, you’ll notice that on the very first payment of $1798.65 that $1,500.00 is put toward interest and $298.65 toward the principal – but by the very last payment, $1,789.70 went to the principal and only $8.95 toward the interest.

Creating an amortization schedule is a great way for homeowners to track their progress and further understand their mortgage payments. You can ask your lender if they provide them or with a little math, you can create your own!