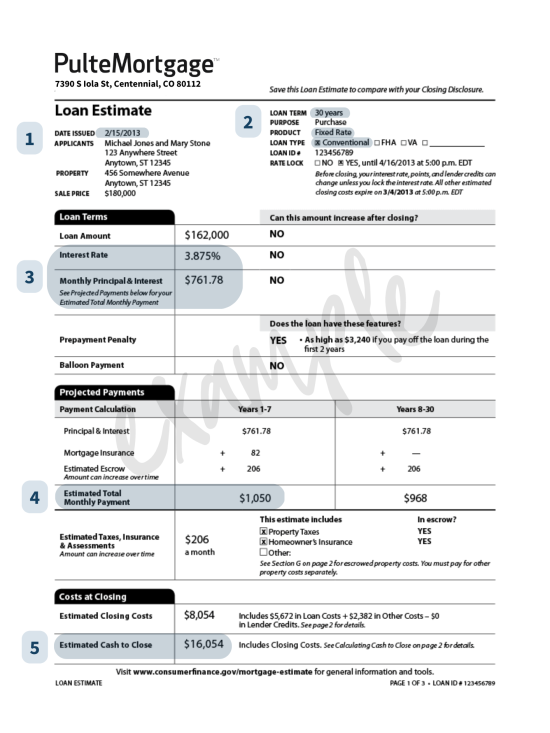

A Loan Estimate is one of the most important documents you’ll receive when financing your new home. This document – which was formally known as the “Good Faith Estimate” – includes everything you need to know about your mortgage. This includes your interest rate, upfront loan costs, monthly payments and closing costs.

Every Loan Estimate (LE, for short) comes in the same format, making it easy to compare rates and fees from different lenders side-by-side. Below we have an example LE and a few key sections you’ll want to pay close attention to.

1. Date Issued – This is the date that your lender generated the Loan Estimate, making the information listed on the document accurate from that day until its expiration.

2. Loan Term + Type – Make sure the information matches what you discussed with your lender.

3. Interest Rate + Principal & Interest – Your interest rate should also match what you discussed with your lender. The principal(the amount you will borrow) and interest (the lender’s charge for lending you money) will make up the main components of your monthly mortgage payment.

4. Estimated Monthly Payment – This is the total payment you will make each month, including mortgage insurance and escrow, if applicable. Make sure you are comfortable spending this much on housing each month!

5. Estimated Cash to Close – This is the amount you will have to pay at closing, in addition to any money you have already paid. This payment is usually made by cashier’s check or wire transfer.

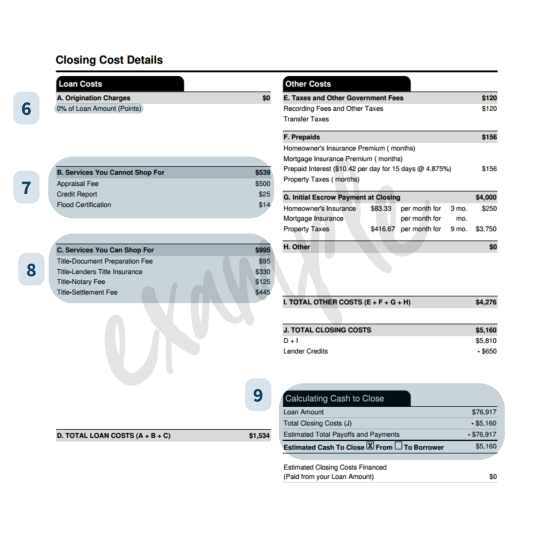

6. Origination Charges – This section will list all of the charges necessary for originating your loan. For example, these may include underwriting fees, origination fees, processing fees, or points.

7. Services You Cannot Shop For – The services and service providers in this section are required and chosen by the lender.

8. Services You Can Shop For – The services in this section are required by the lender, but you are welcome to shop for these services separately.

9. Calculating Cash to Close – This is the estimated amount you will have to bring to closing. This includes your down-payment and closing costs, minus any deposit you have already paid to the seller, any amount the seller has agreed to pay toward your closing costs (seller credits), and other adjustments.

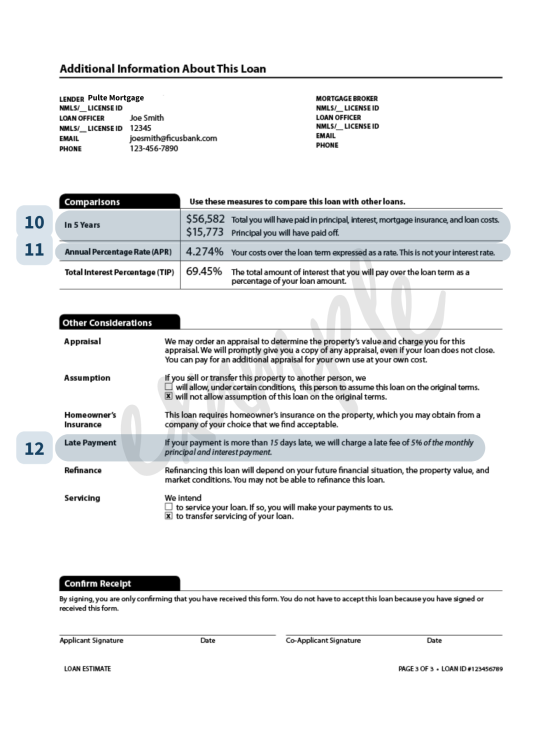

10. In 5 Years – This shows how much you will have paid and how much you will have paid off in 5 years.

11. APR – The APR represents your total loan costs over the life of the loan, including interest and upfront costs, expressed as an annual percentage.

12. Late Payment – It’s important to make your mortgage payments on time and in full every month to avoid fees and improve your credit record. However, it’s good to know in advance how much the fee will be if your payment is late.

Remember, receiving a Loan Estimate does not mean you’re approved for a mortgage. This is only an estimate based on the initial look at your Loan Application. Once you decide to move forward with a lender, you will still have to provide additional documents to support the information on your Loan Application.