In an ideal scenario, you would buy your home when both mortgage interest rates and home prices are low – but in reality, you might be waiting a long time to hit that sweet spot. So, which is more important, a drop in housing prices or a low interest rate? Let’s break down how each factor can impact your buying power.

Reminder: The decision to buy a home should always be based on your ability to afford the down-payment and monthly payments, as well as home repairs and emergencies. It’s important to consider these factors first when looking to buy a home!

Your Monthly Payment

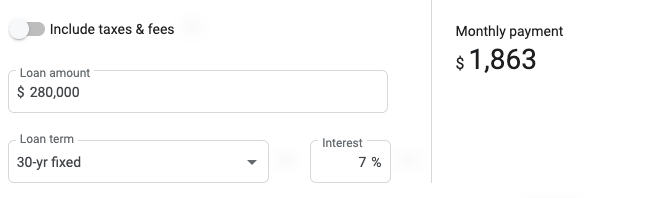

In this simplified example, let’s say you begin your home search when interest rates were 7% and you find a home for $350,000. With a 30-year mortgage, after a 20% down-payment, you have a monthly payment of $1,863.

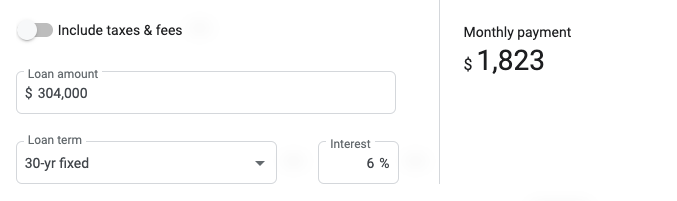

You decide to wait six months and the interest rate drops to 6%, but the same home now costs $380,000. You still put 20% down, with the same mortgage terms, and your monthly payment drops to $1,823.

Your Down-Payment

In the example above, the monthly payment was $40 less with a lower interest rate, however, that is assuming you could still put 20% down on the increased home price. What if you didn’t have the additional $6,000 to put toward the new down-payment? This could significantly decrease your buying power when shopping for homes.

At the end of the day, the best time to buy a home will always be when the mortgage terms are most comfortable for you and your needs. You’ll want to calculate both the short- and long-term costs of a lower interest rate versus a lower sales price before deciding.

Despite interest rates being higher today than they were a couple of years ago, many customers can still buy a home with a similar monthly payment now that home prices have begun to stabilize into a healthier market. If you’re financially ready to buy a home, now is still a great time to buy your dream home!

To learn more about our home financing process, visit our website today!