At its core, a 2/1 rate buydown is a strategic financial move within the realm of mortgages. It’s a temporary reduction in your interest rate, specifically structured to lower your mortgage payment during the first two years of your loan – making it an enticing incentive for new homeowners!

With a 2/1 rate buydown, your interest rate will be:

- 2% lower in year one

- 1% lower in year two

- Then back to your regular fixed rate for the remainder of the loan

A 2/1 rate buydown not only makes homeownership more accessible during the first two years of your loan, but it also frees up funds for other priorities. Redirect these monthly savings toward outfitting your new home, paying-down existing debts, or simply adding to your savings account!

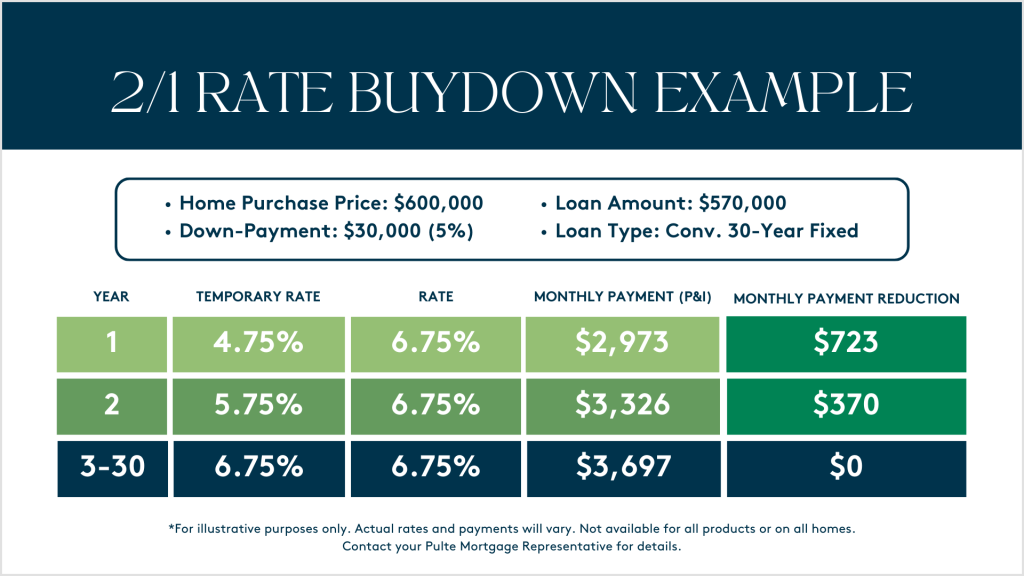

Here’s an example of what those monthly payment reductions may look like:

Curious about the savings a 2/1 rate buydown could bring? Reach out to your Pulte Mortgage Representative today. It’s a great time to explore how this strategic move may make your dream home even more attainable!