As move-up homebuyers seek to elevate their living spaces and expand their horizons, understanding the nuances of a jumbo loan could come in handy. Let’s dive into the world of jumbo loans and discover how they pave the way to your dream forever home!

What is a Jumbo Loan?

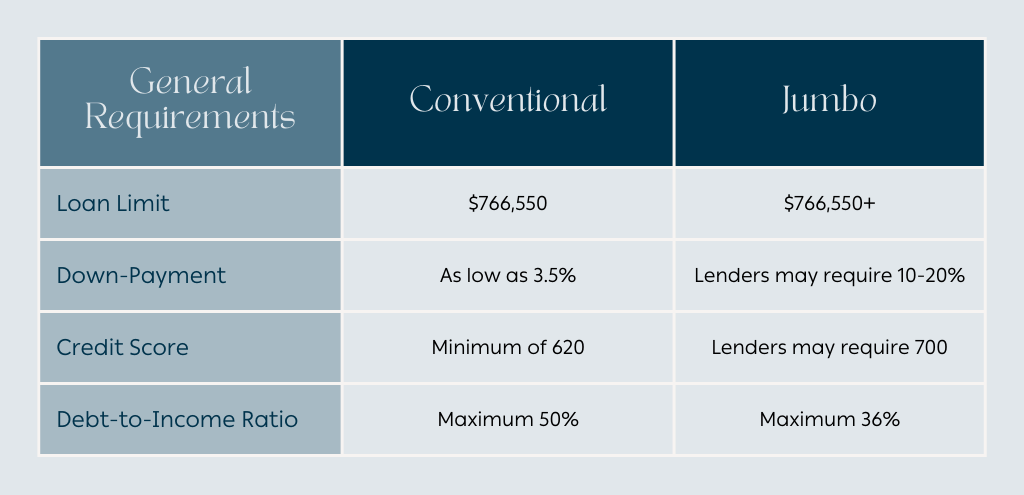

A jumbo loan is a type of mortgage used to finance properties that are too expensive for a conventional conforming loan. As of 2024, the maximum amount for a conventional loan is $766,550 in most counties. Jumbo loans provide the financial flexibility needed for higher-priced homes that exceed these local loan limits.

How Does a Jumbo Loan Work?

A jumbo loan works just as any other mortgage, however, because there is more money involved, these loans can be considered riskier for lenders. Homebuyers who are seeking a jumbo loan will likely have to meet stricter qualification criteria, such as an excellent credit score, a low debt-to-income ratio and may require a higher down-payment.

Jumbo Loan Requirements

Note: The following chart is intended as a general guide. Lenders often have their own criteria that may differ from the above. Please reach out to your lender for exact qualification requirements.

If you’re seeking high-value properties beyond the limits of conventional financing, exploring jumbo loans with a trusted lender can open doors to your dream home! Reach out to your Pulte Mortgage Loan Consultant if you have any questions.