When you embark on the journey of financing your new construction home with Pulte Mortgage, you are not alone! There is a dedicated team of professionals here to guide you every step of the way, ensuring a smooth and successful homebuying experience. Here’s a breakdown of the key players you’ll be working with and how they will help!

Mortgage Financing Advisor

Meet your first point of contact, your Mortgage Financing Advisor! They will oversee your homebuying process and will be available to answer any questions you may have throughout your financing experience!

Kelly’s piece of advice for new homebuyers? “Also, be prepared to submit documentation at two different times – once during the approval process and again before closing. Since new construction timelines are longer than buying an existing home, a lot of the documents will expire before closing.”

Team Assistant

The Team Assistant, or TA, supports your Mortgage Financing Advisor and will work with you to collect the necessary information needed for your Loan Application!

For new buyers about to start their journey, Maria suggests “checking in with each credit agency and lifting any credit freezes.” You can reach out to the following credit agencies to discover if you have any freezes on your credit:

Equifax: 800-203-7843

Transunion: 800-916-8800

Experian: 800-493-1058

Loan Consultant

Next, you’ll meet your Loan Consultant! They will be responsible for reviewing your Loan Application and provide you further guidance on your loan options. After gathering any additional documents needed, they will pass your loan file on to the Underwriter!

For new homebuyers looking to purchase a new construction home, Dan says “Having realistic expectations of the payments you’ll be taking on can be tremendously helpful while looking at homes. You want to make sure you’re setting you and your family up for success when achieving homeownership!”

Loan Processor

Your Loan Processor will work alongside your Loan Consultant and Underwriter to ensure your loan file remains on track. Their attention to detail is crucial for a smooth, stress-free loan approval process!

Tricia has one piece of advice for new homebuyers, “Ask questions! I love when I have customers who are curious about the process. I like to share my knowledge and personal experience with buying a new construction home.”

Underwriter

Once submitted to your Underwriter, they will review your file with a fine-tooth comb before making the final approval decision. They will review and verify your credit history, employment details and finances to determine if you meet the loan’s criteria.

Note: Don’t be surprised if your Underwriter request documentation to verify certain aspects of your loan file that may require further investigation.

Dustin’s advice for new homebuyers: “The more information you can provide up front, regarding your income and assets, the smoother the process will go.”

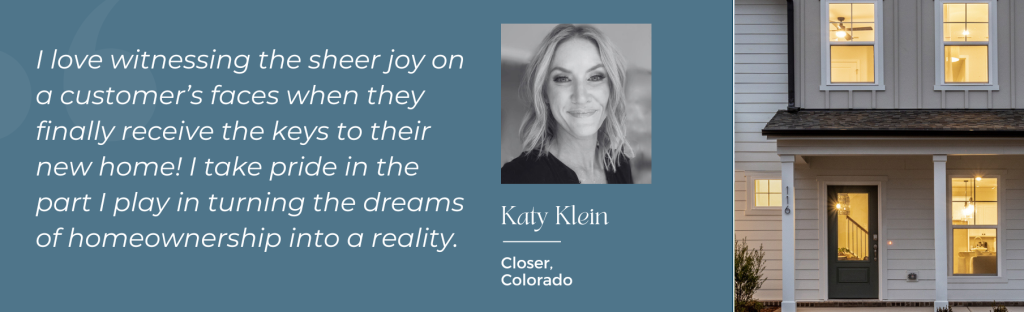

Closer

After the final approval from your Underwriter, the Closer will coordinate the final stages of the loan process. They will send you the preliminary Closing Disclosure and coordinate with the title company to prepare for your closing day!

Financing a new construction home with Pulte Mortgage means partnering with a team of dedicated professionals committed to your success. Each team member plays a vital role in ensuring your homebuying process is smooth and efficient. By working together, we make your dream home a reality!