With so much information about homebuying out there, it’s easy to get bogged down by all the misconceptions and myths. In this blog, we’ll debunk some of the most common homebuying myths for first-time homebuyers to help you approach the process with confidence and clarity!

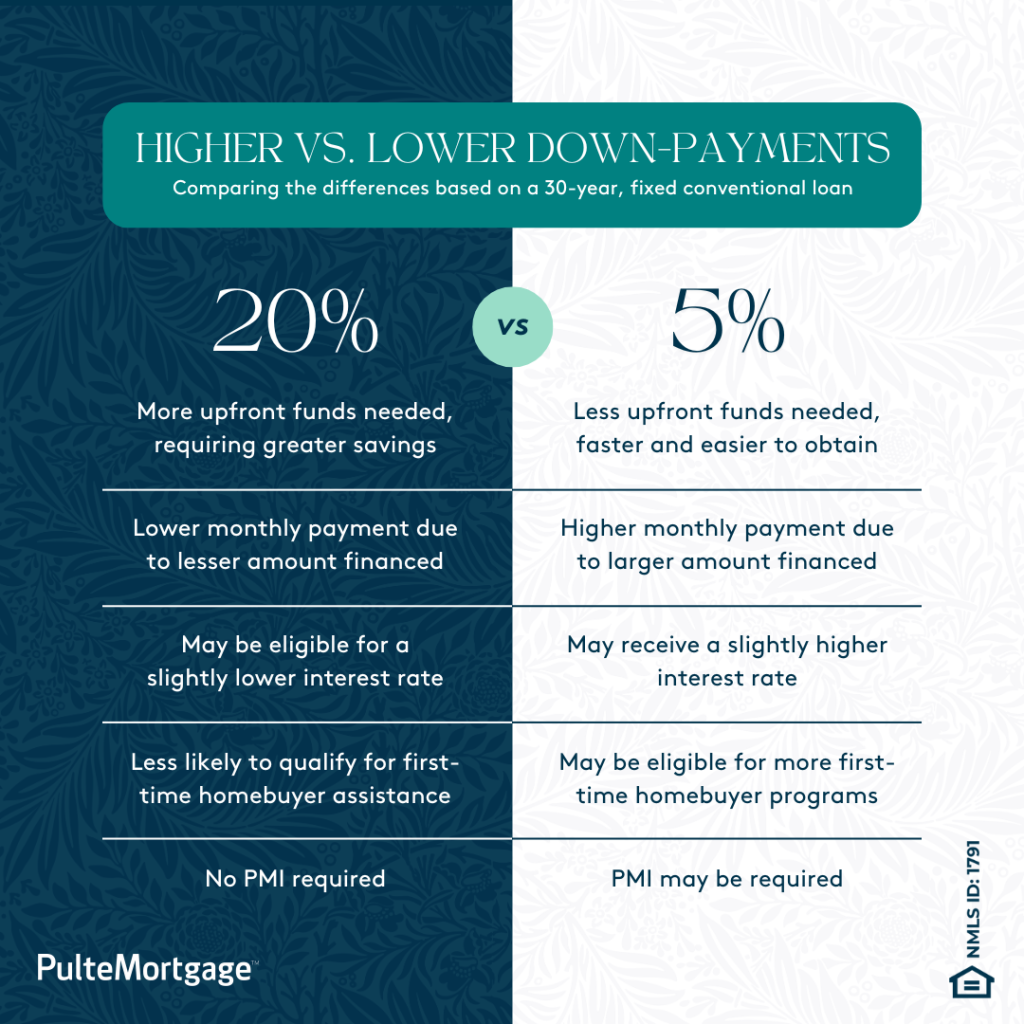

Myth 1: You Need a 20% Down-Payment

One of the most pervasive myths in homebuying is that you need a 20% down-payment saved. While there are benefits to putting down 20% or more, such as lowering your monthly payments and avoiding private mortgage insurance, it may not be a requirement to qualify for a home loan. Many loan programs allow for as little as 3.5% down! When considering how much to put down, evaluate your current finances and long-term goals to determine how much of a down-payment will best suit your needs.

Myth 2: You Can’t Buy a Home While in Debt

Carrying debt can be a significant financial burden, but it doesn’t automatically disqualify you from buying a home! Lenders will review your debt-to-income ratio (DTI) to understand how well you can manage your debts compared to your gross monthly income. These debts can include student loans, auto loans, credit cards and more. No matter the debt amount, it is crucial to manage it responsibly and demonstrate a stable income!

Myth 3: I Need a Perfect Credit Score

Having a healthy credit score is important, but it may not need to be perfect to qualify for a mortgage. Lenders are looking at your overall financial health, which includes your income, debts, assets and down-payment amount––not just your credit score. Each loan program may have varying credit score requirements. Improving your credit score can help you secure better loan terms, but don’t let the fear of less-than-perfect credit hold you back from owning a home, if you qualify!

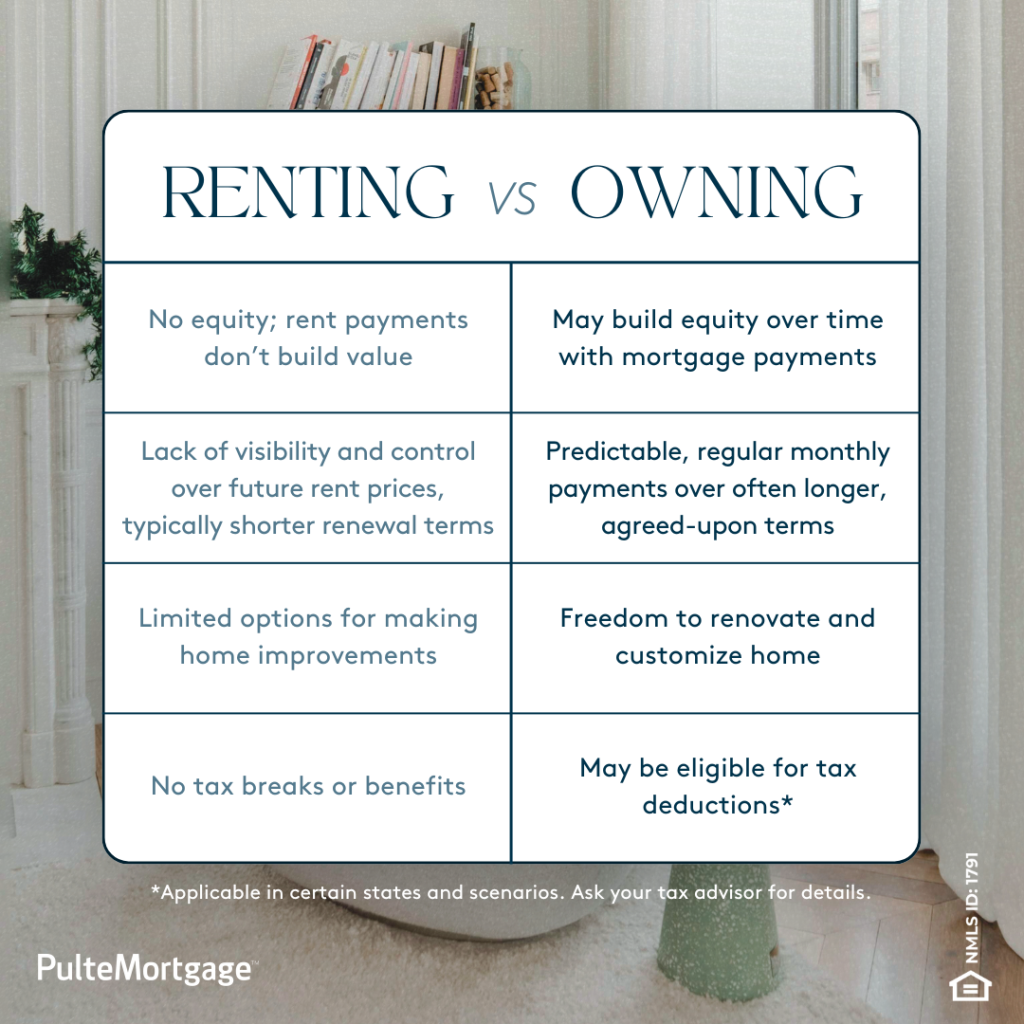

Myth 4: It’s Cheaper to Rent Than to Own

While renting may seem cheaper in the short term, in many areas owning a home can be more cost-effective in the long run. When you finance a home, each monthly mortgage payment gets you one step closer to owning your home outright, which may create equity that you can use in the future. Buying a home may cost you more upfront––with a down-payment, closing costs, moving fees and more––but in the long-term, owning a home may be a much better investment for your future.

Myth 5: A Down-Payment Is All You Need to Save

The down-payment is a big component to buying your first home, but it isn’t the only expense you’ll need to prepare for as a first-time homebuyer. You will also need to budget for the closing costs, home inspection, appraisal, and general moving costs. It is also wise to have an emergency fund in place to cover any unexpected expenses that may arise after you move in.

Myth 6: All Lenders Are the Same

Not all lenders are created equal! At Pulte Mortgage, we have decades of expertise in new construction lending. From start to finish, our Loan Teams work hand-in-hand with your builder to closely coordinate your financing with the construction of your new home. For a one-stop homebuying experience, choose Pulte Mortgage!