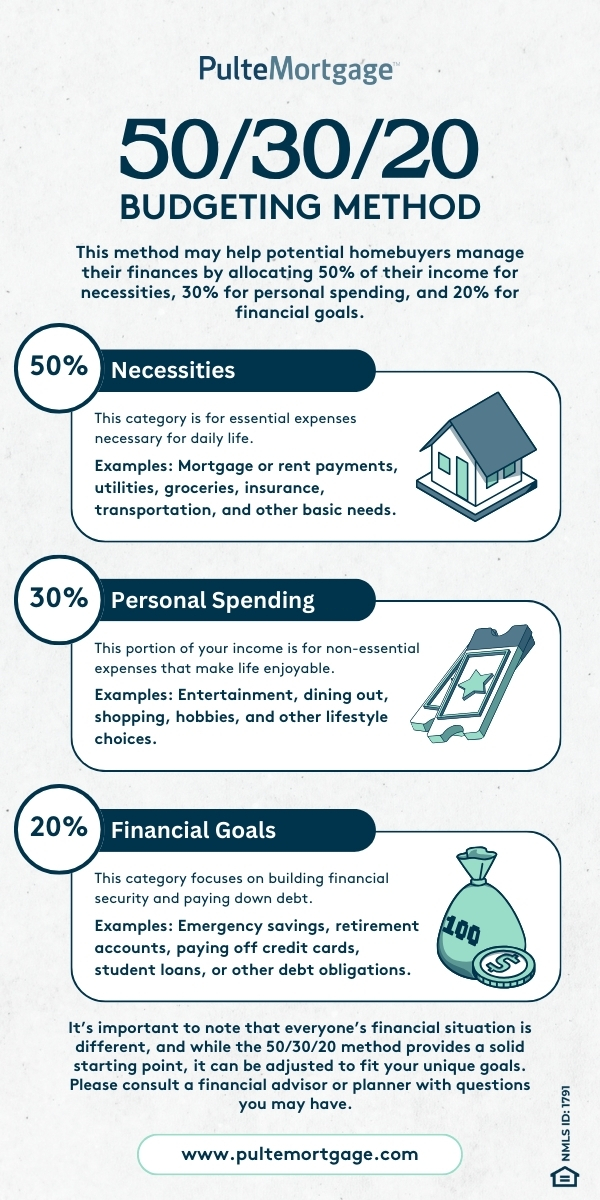

Managing your income effectively is key to building financial stability and ensuring you can comfortably afford your mortgage and other expenses. If you don’t know where to start, the 50/30/20 rule is a well-known budgeting method that can help you allocate your income thoughtfully! Here’s how it works and why it’s a great approach for anyone planning for or adjusting to homeownership.

What is the 50/30/20 Budget Method?

50% for Necessities

This category is reserved for essential expenses, those necessary to maintain your day-to-day life.

- Examples: Mortgage or rent payments, utilities, groceries, insurance, transportation, and other basic needs.

- For potential homeowners, your mortgage payment will likely be the largest expense in this category, so it’s important to plan for it carefully.

30% for Personal Spending

This portion of your income is for non-essential expenses that make life enjoyable. Allocating for personal spending ensures you can enjoy your money without overspending in areas that could detract from your savings or essential expenses.

- Examples: Entertainment, dining out, shopping, hobbies, and other lifestyle choices.

20% for Savings and Debt Repayment

This final category focuses on building financial security and paying down debt.

- Examples: Emergency savings, retirement accounts, paying off credit cards, student loans, or other debt obligations.

- For potential homebuyers, building a solid emergency fund is especially important to cover unexpected costs like home repairs or unplanned expenses after moving in.

It’s important to note that everyone’s financial situation is different, and while the 50/30/20 method provides a solid starting point, it can be adjusted to fit your unique goals. Please consult a financial advisor or planner with questions you may have.

The 50/30/20 budgeting method is a flexible guideline that can help you think about your finances in a structured way and provide a strong foundation for long-term financial success. Start small, stay committed, and watch your progress grow as you either work toward homeownership or adjust to life as a new homeowner!

Start your 50/30/20 budget today and take the first step toward becoming a homeowner! Learn more about the Pulte Mortgage home financing process by visiting our website.