Summer is often a popular time to purchase a home thanks to warmer weather, longer days and the break between school years – and unfortunately, that also makes it prime season for scams. As buyers move through the mortgage and closing process, cybercriminals ramp up their phishing and wire fraud attempts to target these large transactions. At Pulte Mortgage, we want your journey to homeownership to be smooth, secure and stress-free! Let’s walk through how you can protect your information and avoid wire fraud during the homebuying process by spotting these popular mortgage phishing scams.

What is Phishing?

Phishing is a common type of cyber-attack that targets individuals through email, text messages, phone calls, and other forms of communication. Cybercriminals use deceptive communication tactics to lure these individuals into providing sensitive data, such as passwords or banking and credit card information.

For mortgage transactions, these scammers pose as your lender, title company or real estate agent to trick you into sending sensitive information or wiring funds to the wrong account. These messages can come via email, text, or even phone calls, and they’re often very convincing.

Red Flags of a Mortgage Phishing Scam

- Slight misspellings or odd characters in an email address.

- Urgent or last-minute changes to wiring instructions.

- Poor grammar, typos or awkward phrasing.

- Unusual file attachments or links

- Pressure to act immediately.

What is Spoofing?

Spoofing is a common method scammers use while phishing to impersonate someone you trust. The goal is the same: to trick you into sharing sensitive information or wiring hard-earned funds to the wrong account. Spoofing can take several forms and can be tricky to notice if you’re not paying close attention.

Common Types of Spoofing:

Email Spoofing: This is when a scammer forges an email address to make it appear like it is coming from your lender, title company, or real estate agent. They may copy email signatures and logos to make it look official.

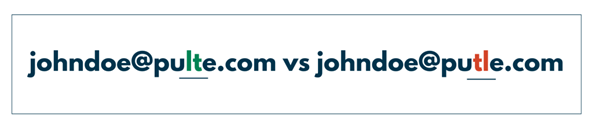

Domain Spoofing: In this case, scammers create fake websites or email addresses that closely mimic the real ones. The differences are often subtle, like a small typo or an extra character in the domain. These spoofed domains may link to fake login pages or documents meant to steal your personal information.

See the below example. Both email addresses may look legitimate at first glance, but with a closer look, you’ll notice that the second domain has a slight misspelling.

How to Protect Yourself from Spoofing

- Always double-check the sender’s email address, not just the name that appears in your inbox!

- Hover over links before clicking to preview the URL and ensure its legitimate.

- If something feels off, don’t click. Never hesitate to call your loan team or title company directly to verify any information. Your team understands the risks scammers pose and are there to help you every step of the way!

How Pulte Mortgage Helps Protect You

At Pulte Mortgage, we use secure communication tools like our Loan Dashboard and multi-factor authentication to keep your data and documents safe. As a reminder, we will never ask for sensitive information through unsecured channels such as text message or email and we encourage you to reach out any time you’re unsure about a message you’ve received.

These are the tips we share with all of customers, and we encourage you to keep them in mind throughout your mortgage journey.

1. Call, Don’t Email

Before wiring any funds, call your title company directly using a trusted phone number (not the one listed in an email). It’s extremely rare for title companies to change wiring instructions via email, so always confirm payment details by phone or in person.

2. Be Suspicious

If something feels off – even slightly – trust your instincts. Call your lender or title company right away if you receive an email that mentions wiring instructions, especially if it includes last-minute changes or feels rushed.

3. Verify Immediately

Before sending your wire, ask your bank to confirm the account name matches the title company. Then call your title company as soon as the wire is sent to confirm they received the funds. If something goes wrong, catching it quickly gives you the best shot at recovery.

Buying a home is an exciting achievement, don’t let scammers ruin your moment! Take your time, stay alert, and always double-check anything that seems out of the ordinary.