When the Federal Reserve announces a rate cut, it often makes headlines. This can spark many questions for potential homebuyers — Does a fed rate cut mean mortgage interest rates will go lower? Is now a good time to buy? The reality is, while the Fed’s decisions do influence the broader economy, mortgage rates respond to many factors beyond that. Let’s take a closer look at what a Fed rate cut actually means for mortgage rates — and what it doesn’t.

What is the Federal Reserve System?

The Federal Reserve, often called “the Fed,” is the central bank of the United States. It was established in 1913 to help keep the country’s financial system stable and flexible. This independent agency is responsible for these key functions:

- Conducts the nation’s monetary policy

- Promotes financial system stability

- Supervises and regulates financial institutions

- Fosters payment and settlement system safety and efficiency

- Promotes consumer protection and community development

In short, the Fed helps guide the economy, and their decisions can influence things like inflation and borrowing costs.

Source: federalreserve.gov

Why Does the Federal Reserve Cut Rates?

When the Fed cuts interest rates, they are lowering the rate banks charge each other when lending money overnight to meet the federal reserve requirement. These cuts are important because a lot of interest rates — including credit card, auto, and savings accounts — often utilize this target rate as a reference point for setting their own rates. While these cuts are usually in small increments, their goal is to stimulate the economy by:

- Lowering Borrowing Costs

- Stimulating Business Growth

- Encouraging Spending

How Does a Fed Rate Cut Impact Mortgage Rates?

While both the federal fund rate and mortgage rates are influenced by economic conditions, they don’t necessarily move in lockstep. For example, a 0.25% Fed rate cut does not automatically mean mortgage rates will drop by the same amount. While a Fed rate cut could be a signal of lower borrowing costs, it is not a guarantee.

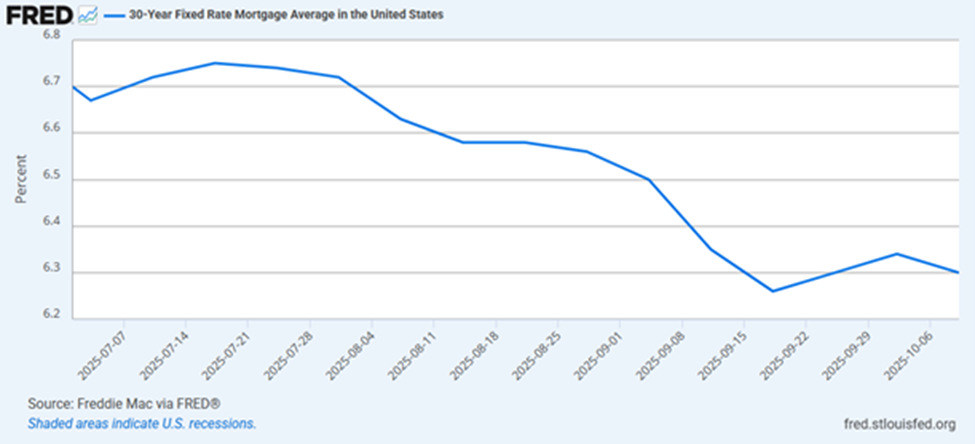

Fortunately, here’s the good news: mortgage rates have been trending downward in recent months. Take a look!

Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MORTGAGE30US, October 15, 2025.

It is important to remember that mortgage rates are influenced by many factors beyond the Fed’s decisions. If you’re considering buying a home, it is best to talk to your Loan Team about your goals so they can help guide you in the right direction. Remember, the best time to buy a home is when it is right for you!

To learn more about our home financing process, visit our website today!

This blog was written by Meagan Rochard, a financial services writer at Pulte Financial Services with seven years of experience in homebuilding and mortgage content.