With an ever-changing real estate market, the question of whether it is a good time to buy a home often lingers in the minds of today’s homebuyers. While interest rates rose from historic lows, for those who are financially ready to buy a home, there are several compelling reasons why now is still a good time to buy a home in this housing market!

When is the Best Time to Buy a House for You?

The decision to buy a home is a significant milestone that requires careful consideration, particularly in a dynamic real estate market. Here are some factors that should influence your decision on whether it’s the right time to embark on the exciting journey of homeownership.

Financial Readiness

Your financial health is the most important factor when deciding if now is a good time to buy a home. Take some time to assess your credit score, your debt-to-income ratio, and your savings to ensure that taking on a mortgage aligns with your overall financial goals.

Housing Market Conditions

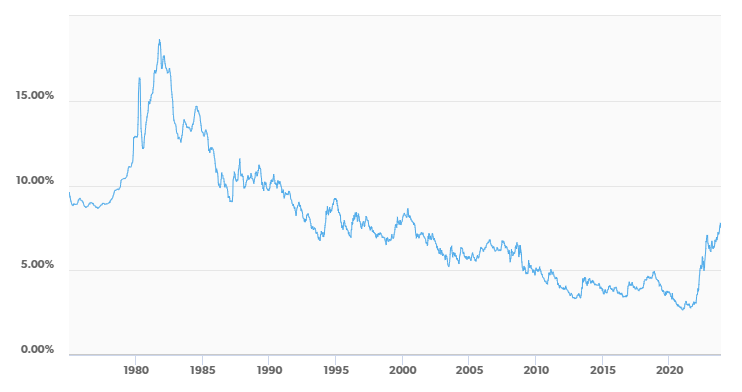

The housing market is always changing, so staying current on today’s market conditions is a must for anyone considering a new home purchase. Keep an eye on interest rate trends, local housing inventory, and recent sales in your desired neighborhoods. Leverage online resources, consult with professionals, and explore market reports to gain further insights into the housing market conditions. Every homebuyer’s financial circumstances are unique, and by staying informed you can empower yourself to make decisions aligned with your goals, no matter what the market looks like!

Benefits to Buying a Home in Today’s Market

Less Competition

With interest rates no longer at historic lows, it has allowed the housing market to cool off a bit. Combined with the decline of stressful bidding wars and above-asking-price offers, this could mean less competition (and stress!) when searching for a new home.

Builder Incentive Offers

As the market begins to shift, now could be a great time to take advantage of incentive offers from your homebuilder! These incentives could include covering your new home’s closing costs or temporarily lowering your interest rate with a buydown. Reach out to your local Pulte Mortgage Financing Advisor to learn more about the incentives in your area!

Determine Your Homebuying Priorities

Homebuying isn’t solely driven by market trends; it’s often a reflection of life’s pivotal moments. Here are some of the most common life priorities that steer individuals and families toward homeownership!

- Family – When considering a new home, many buyers place their family at the forefront of their priorities. For some, it’s the anticipation of expanding their family and the need for additional space. For others, it’s the heartfelt decision to move closer to their existing family to create a sense of unity.

- Space – Some homebuyers are driven by the need for more space as they expand their family or to accommodate a new lifestyle. Others opt for a downsized haven, valuing efficiency, simplicity, and a more manageable living environment.

- Career – Whether you want to cut down on your commute or you’ve gone remote and need more space, embracing a better work-life balance is key to many homebuyers.

- Lifestyle – Many homebuyers take their lifestyle into consideration when looking to buy a home. Whether it’s urban conveniences or suburban tranquility, your desired lifestyle will be a big factor when choosing to buy a home.

While interest rates may be inching up, the current housing market continues to present great opportunities for prospective buyers. Beyond the financial aspect, the emotional rewards of owning a new home remain unparalleled. The potential for long-term wealth building and the security of a place to call your own are timeless aspects that transcend the current market!